VA Home Loans

What is a VA loan?

VA loans are offered by the U.S. Department of Veterans Affairs (VA) (previously the Veterans Administration). Military people, veterans, and their surviving spouses may purchase houses with a little down payment, no home insurance, and an appealing interest rate using VA loans.

How is a VA Loan Works?

VA loans can help active military personnel, veterans, and their spouses who survive them be homeowners. They can provide as much as 100% of the home’s value. The eligible borrowers can take advantage of a VA loan to buy or construct a house, improve or repair the property, or refinance a mortgage.

The VA determines the eligibility criteria, sets the conditions of the mortgages they offer, and guarantees loans. However, it doesn’t provide a loan. The alternative is that the VA’s home loans are offered through private lenders, like mortgage and bank companies.

If borrowers want to seek loans, they must give the lender the certificate of eligibility issued by the VA. To obtain this certificate, you’ll need to provide documentation related to your service that may differ depending on whether you’re in the active military or a veteran. The certificate is available through the VA’s website. While some of the lender’s underwriting rules have to be satisfied, VA loans are often easier to obtain than conventional loans.

Loans from VA, Federal Housing Administration (FHA) loans, and other loans insured through departments within government departments of the United States government have securitization through the Government National Mortgage Association (GNMA), Also called Ginnie Mae. The guarantee covers these securities from the government of the U.S. government against default.

What are the VA Loan Conditions?

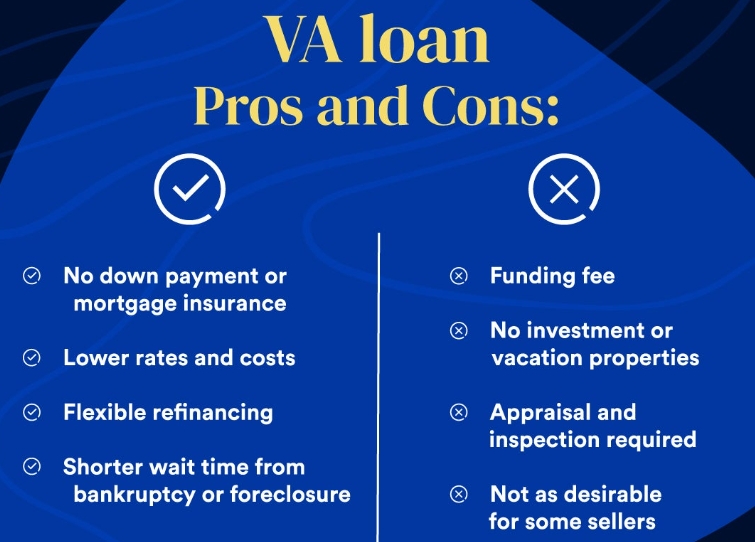

The conditions that apply to VA loans are very spacious compared to other mortgages and Federal loan programs. There are many benefits to VA loans:

- A down payment is not required unless it is required by the lender or if the property’s purchase price is higher than the property’s value.

- There is no requirement for private mortgage insurance.

- Costs for closing are not a lot and can be borne by the buyer.

- There is no penalty for prepayment when the borrower repays the loan earlier.

- The VA offers assistance to assist borrowers in avoiding the risk of default.

The score on credit minimum requirements can differ between lenders. The only VA credit condition is that an applicant is deemed a reasonable credit risk to a lender. The advantages of the VA credit are precisely the same regardless of the lender you select.

What are The types of VA Loans?

The VA offers a variety of mortgage loans.

Home Purchase Credit

VA Home purchase loan assists veterans purchase a house with low interest. The purchase loans typically don’t need a downpayment or the purchase of private mortgage insurance.

Cash-Out Refinance Loans

Refinance cash-out loans permit mortgage holders to access the home equity to pay off debts, schools, or home improvements. Refinancing is a way to get the possibility of a new mortgage with more than the current note and transforms the equity in your home into cash.

Interest Reduction Rate Refinance Loan

Refinancing with interest rate reduction loans (IRRRLs) are often referred to as VA Refinance Loans. These streamline and assist borrowers in getting a lower interest rate through refinancing their VA loans. It is a process that converts a VA loan into a VA loan, allowing homeowners to refinance their fixed-rate loan with a lower interest rate or correct the variable-rate loan.

Native American Direct Loan

This Native American Direct Loan program aids people who are eligible Native American veterans to finance the purchase, construction, or repair of homes located on trust property owned by the federal government. Reduced interest rates also accompany these loans.